Whether you’re an electronic security integrator or an AV integrator, you’ve probably heard a lot about recurring monthly revenue (RMR) lately, including why it’s in your interest to reorient your business toward it.

RMR refers to revenue that integrators can bank on — no pun intended! — separate and apart from capital project cycles. You don’t need to re-win these monthly, quarterly or annual checks — for intrusion/burglar alarm monitoring, cloud-based services, video intrusion alarm verification, fire alarm inspections, etc. — afresh each time.

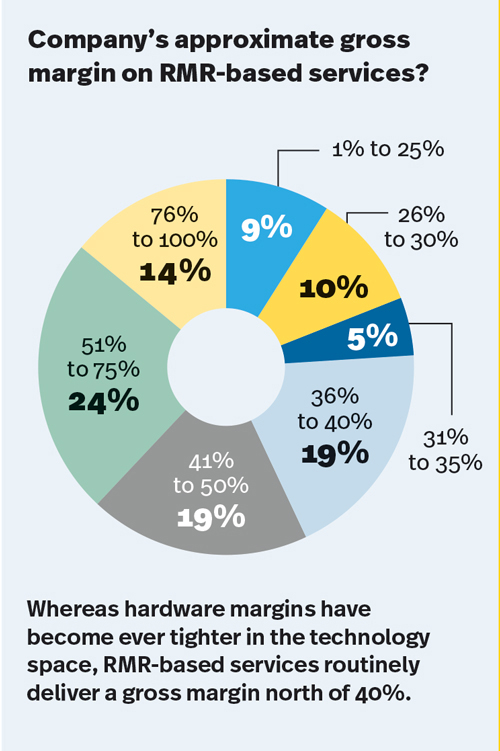

In a sense, that revenue is on autopilot, coming in regardless of economic conditions, global pandemics or unexpected gaps between big-ticket capital projects. And the margins integrators earn on services-based RMR are almost always far greater than the margins earned from simply reselling and installing security equipment.

Confronting Persistent Skepticism

Nevertheless, there remains persistent skepticism from some corners of the integration community — especially on the AV side, but also in security — about shifting away from a project-centric approach.

Some integrators might say, “Our strategy has served our company well for decades, providing for our team’s families and delivering us solid growth. Why change now?”

Others might worry about how to reward their salespeople, who are accustomed to earning sales incentives based on large-dollar capital projects — not smaller-dollar subscription payments. Others might say that marketplace demand and acceptance isn’t where it needs to be for an RMR-focused integration business to succeed.

There’s also the issue of how to earn organization-wide buy-in.

For Security Sales & Integration’s Recurring Monthly Revenue Deep Dive, we solicited input from three of the electronic security industry’s most knowledgeable figures: Michael Hanlon, VP, hosted and managed solutions, Allied Universal; Chris Peterson, founder and president, Vector Firm; and John Nemerofsky, COO, SAGE Integration.

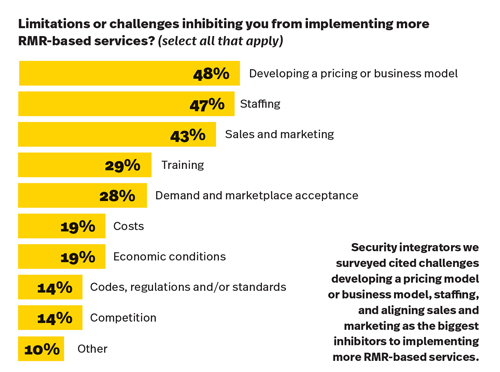

In this wide-ranging discussion, they examine the opportunity at security integrators’ disposal and how they can maximize it. We punctuate that discussion with graphical breakouts, sharing exclusive survey data that CI+SSI captured from an industry-wide study of our integrator readers.

Still Opportunistic

“Currently, growing RMR and shifting to an OpEx-driven model is still opportunistic,” Peterson opines. “I believe that integrators who make this move will be able to dominate their marketplace.”

He concedes that those who don’t will still be in a decent position — but perhaps not for long.

“Very soon,” Peterson predicts, “those who are not able to deliver services will be in deep trouble.”

We readily concede that this type of warning has been out there for 10-plus years, and Peterson acknowledges as much.

“But the difference today is that the manufacturers have been able to market to the end users,” he explains. “And now they’re starting to ask for these types of services. Soon, they’ll be demanding them.”

Hanlon agrees, saying that OpEx and subscription models benefit security integrators and end users alike. This “balance of benefit,” as he puts it, is foundational to the shift to a new model.

“We are increasingly seeing educated customers who want to consume ‘as-a-service’ to manage growth, preserve capital, and maintain flexibility and ‘anti-obsolescence,’” Hanlon observes.

Given the fact that installed technology is, by its nature, a depreciating asset, many customers have come to realize that it’s in their interest not necessarily to procure and own gear but, rather, to find a partner who will assure an outcome — perhaps without large, upfront capital outlays.

The cost of money these days is driving that thinking, as is the rise of cloud solutions, which show a way to move beyond on-prem hardware integration.

Nemerofsky, whose firm’s RMR currently stands at 14.5% of total revenue, puts it even more forcefully.

“RMR is critical to a security systems integrator’s financial stability, client retention, valuation, scalability and competitive advantage,” he declares.

Aligning with Hanlon’s idea of a “balance of benefit,” Nemerofsky underlines that OpEx models offer greater client appeal by reducing financial barriers and incentivizing long-term relationships, all while maximizing flexibility and innovation in their facilities.

RMR Brings a Focus on Constant Growth

You might think that SAGE Integration, with nearly 15% of its total revenue coming from RMR, is just resting on its laurels, but you’d be wrong. The company’s goal, in fact, is for RMR to be 25% of total revenue. What’s more, Nemerofsky says it’s on track to achieve that goal.

“SAGE has been growing our RMR percentage by 25% per year,” he enthuses. The company’s secret, Nemerofsky says, is staying focused on its Ideal Client Profile (ICP), as well as offering clients a wide range of subscription services to solve their current-day challenges.

Hanlon, meanwhile, works for Allied Universal, a company that bills itself as the largest security company in the world and whose core business is physical guarding.

“RMR, or measured billing, allows our integration business to design systems for technology-enabled guarding,” he explains. “We have built [upon] a foundation of designing technology-enabled guarding solutions on an RMR model.”

The company operates with a risk-based approach, focusing on outcomes and benefits while working with clients to align budgets and reduce threats.

It’s the essence of the outcome-centric mindset that lies at the heart of subscriptions and services — that is, success does not come when a physical system is installed but instead comes with the outcome of actual threat reduction.

Markets to Target for Increased RMR

If you find SAGE Integration and Allied Universal’s testimonies compelling, you might be wondering which markets present the ripest RMR opportunity. SSI posed this question to Peterson, who said the conventional answer might be small businesses, companies with multiple locations and the like.

But Peterson actually rejects that formulation, and he encourages integrators to adopt a more thoughtful strategy.

“While it’s true that these types of markets need the services that create RMR, I don’t think companies should blindly start pursuing them,” he opines.

Most of these services provide value to organizations of all types, Peterson says, but many companies don’t have an immediate-term need for the services.

“And that’s where we’re missing huge opportunities,” he adds. “Salespeople think, ‘They don’t need us to manage their access control system, so I won’t mention it to them.’”

“While it’s true that most companies can manage these services on their own, the question is, ‘Should they do it on their own?’ Most of the time, the answer is that they would find more value having a security integrator provide the services,” says Peterson.

Thus, for Peterson, the answer is for integrators to focus on the markets on which they’re already focused.

“Their service agreements or managed services are just as valuable to those markets as any other,” he says, “but the conversation might be about value and not about need.”

Nemerofsky agrees, making the case that all vertical markets need RMR services; he identifies visitor management, managed access control, managed video, single user sign-on and device monitoring as services whose value transcends particular applications or verticals.

For him, therefore, decisions regarding which customers to target fall to a different litmus test.

“I think it is very important that every integrator keeps a strict discipline to their Ideal Client Profile,” he stresses, echoing Peterson’s warning not to blindly chase after opportunities heedless of market nuances or your firm’s core competencies.

Look to the Customer

For Hanlon, the message for integrators is simply to let the customer be your lodestar.

“The integrator should always look to their customer: What need they are trying to solve and how best to do that within a given set of financial, technological and management parameters,” he explains.

That means not selling an on-premise access control system — regardless of its potential as a high-dollar capital sale — when you know that the customer would derive more benefit from a cloud-based solution that your firm could manage and monitor on their behalf.

“Our teams don’t approach their day or clients with a ‘goal’ to sell RMR,” Hanlon states. “Our solutions take into consideration factors such as internal and external threats, budgetary constraints and growth expectations. We then align systems with benefits and value to provide a holistic solution that works for their needs.”

And while Nemerofsky puts forth a concrete list of services that integrators should consider offering — those relating to access control, video managed services, visitor management and weapons detection for starters — Peterson shares alternative advice, urging integrators to start where they already are and offer the services that they’re most ready to deliver.

“Roll out these services one at a time,” he says. “Don’t try to boil the ocean.”

Peterson continues, “If you’ve got an amazing relationship with a manufacturer that has released a cloud version of their technology, then start there. If you’ve got an all-star service team, then start with extended maintenance agreements.”

He thinks it can be risky to pore over the hottest trends and then chase after them.

“Start with services on which you can have the best success and build off of that,” Peterson recommends.

Hanlon echoes that point, adding, “Integrators who aren’t ready to offer a full book of RMR services should focus on the core services that most benefit their customer base.”

Not as Easy as It Sounds

Some CI+SSI readers say that focusing on RMR is simply not their business model, and no amount of our own editorializing will change that fact. Others argue that transitioning is not as simple as articles like this one make it seem; they point to the challenges of earning organizational buy-in and reorienting your sales force.

Our experts are clear-eyed about the hurdles that integrators must overcome to stand up an RMR-focused business model.

“Yes,” Hanlon concedes, “there are marketing, pricing, staffing, commissioning and other considerations integrators have historically avoided,” with some choosing just to dabble in monitoring and RMR rather than diving in headfirst.

“Resistance to change and fear of the unknown are real,” he adds.

But those reservations don’t change the fact that our industry — in particular, vendors and end users — are clearly embracing services. And that means integrators could be left behind, losing out on work and valuable client relationships.

“There are many resources and industry groups, like PSA Security, offering support,” Hanlon says, encouraging integrators to build newfound capabilities atop the sturdy scaffolding of these industry resources.

Peterson, who leads Vector Firm, a company that guides integrators on how to enhance their sales and marketing results, has been helping project-centric integrators increase their RMR services business for 12-plus years.

“And the most common obstacle is that their salespeople are having success without selling RMR,” he explains.

What’s more, most sales associates working in integration businesses haven’t received much (or any) training on how to sell services. In that way, it can seem like they’re being pushed to jettison a proven, successful model in favor of an unproven one on which their footing is unsteady.

Commit to RMR at the Leadership Level

These factors are why Peterson believes integration businesses intent on seizing the RMR opportunity must commit to it at the leadership level and earn universal organizational buy-in.

That means instituting data-based accountability, creating sales compensation plans that reward RMR, building a well-defined menu of services, instilling full confidence in service delivery and, more generally, embracing RMR as a company culture.

“Without these things, all the training in the world won’t help sales,” Peterson warns.

As integrators lean into that RMR-influenced company culture, sales team members will begin to intuitively understand where opportunity lies and which clients to pursue.

For example, an RMR-savvy organization like SAGE Integration knows that regulated utilities aren’t using cloud services, owing to Critical Infrastructure Protection (CIP) standards.

Peterson in turn mentions that some government agencies are not allowed to engage an outside organization for services. Ultimately, over time, integrators will understand not only market demands but also what fits into their own pricing model. The reward will be stronger, longer-term, more unbreakable integrator–client relationships.

“RMR is not only connected to but [in fact] integral to creating long-term, successful partnerships,” Hanlon declares. “Unlike a singular project, an RMR solution demands stickiness and operational value from the installation to connection of service and maintenance.”

When Vector Firm explains the various benefits of RMR to its clients, Peterson and his team go well beyond profitability and business valuation.

“Being able to deliver services will enable an organization to sell more technology and products, build deeper personal relationships, become more of a partner, etc.,” he explains.

It’s a pathway to achieving the holy grail — namely, to be not a contractor or installer but, rather, a consultative partner who stands shoulder to shoulder with the client to guarantee successful outcomes 24/7/365.

What Vendors Can Do About RMR

SSI asked Allied Universal and SAGE Integration which product features, support mechanisms or capabilities they’d most like to see manufacturers deliver to empower integrators to offer services that assure customer outcomes. Hanlon points to integration and overall functionality.

“Manufacturers looking for an all-or-nothing approach do a disservice to themselves, as they are locked out of legacy relationships and do a disservice to the customer in creating a disconnected solution,” he warns.

“The proverbial ‘single pane of glass’ should allow for legacy systems to connect to component or system additions, including emerging AI technologies, robotics, SaaS platforms, detection, etc.,” says Hanlon.

Moreover, he argues that video should be presented to an operator as a validated threat the same way in the same system.

“[This will allow] for resolution or dispatch whether the event was triggered by an access control system, a drone, a robot, or any on-premise or cloud AI solution,” says Hanlon.

For his part, Nemerofsky cites device monitoring, single user sign-on, extended cloud storage, access control, visitor management and video hosting as his wish list for vendor partners to empower his firm to deliver even better, more robust services to clients.

Securing Integrators’ Future

We conclude where we began: with a recognition that, although an OpEx-driven model might still be opportunistic, the day is coming when it might become table stakes. Security integrators’ clients are increasingly savvy, often boasting considerable in-house expertise.

“In the near future, end users will realize that they can simply use the technology from the manufacturer and not pay an integrator,” Peterson predicts. “Integrators must develop professional services that can be delivered through the cloud to stay relevant.”

If your firm can’t develop a robust menu of services and deliver them reliably, your client will find another company that can — or, perhaps worse, just bring everything in-house.

But Peterson doesn’t necessarily see any reason to despair.

“For those who are proactive enough to make these changes, they will have more value [in] the marketplace than they do today,” he promises.